For over 55 years, Christopher Clover’s Marbella Property Market Report is the de facto standard for obtaining up-to-date, reputable and professional Marbella real estate market information

· 59 min. read

Marbella Property Market Report 2026

by Christopher Clover, Managing Director, Panorama Properties

Christopher Clover has been writing about the Marbella Property Market for over 55 years

Since the 1950s, Marbella has evolved into one of Europe’s most distinctive resort destinations, with one of the world’s most resilient property markets. Here, real estate transcends mere investment, embodying the lifestyle, aspirations and enduring allure of Marbella as a world-class destination.

In this report, we explore the key trends and forces shaping the market today, the challenges that come with an evolving landscape, and the outlook for steady, controlled growth in the years ahead.

- Table of contents

- Market Overview

- Tourism: a year-round engine of growth

- Key property market indicators

- Real market evidence

- The rental landscape: key trends in 2025

- Other factors affecting the market

- Looking forward

- Sources

Market Overview

The new normal

The last twelve months have reinforced a pattern of enduring strength, one that has outpaced the cautious outlooks that followed the post-pandemic boom.

Where many expected a cooldown, Marbella instead deepened its standing as a safe haven. The market’s resilience is no longer just a consequence of past momentum, it has become the new normal.

Marbella has stepped onto the world stage as never before and is increasingly recognised alongside global hubs like Dubai and Miami, in addition to every famous resort destination in Europe, for its luxury lifestyle and real estate appeal, despite its far smaller scale.

Marbella is a city thriving at the forefront of its evolution, with a significant potential for sustainable and controlled growth: investment is pouring in, tourism figures continue to be strong, infrastructure projects are being accelerated, and planning regulations are adapting to achieve these ends.

The market’s resilience is no longer just a consequence of past momentum, it has become the new normal

Marbella’s position as a global, ultra-luxury destination

There are few destinations in the world today that can match Marbella’s transformation over the past decades. The city has not only entered, but has consolidated its place among the global elite of ultra-prime residential resort locations. This evolution is not merely symbolic: it is reinforced by international awards, high-end development, Michelin accolades, and the ever-growing presence of a truly cosmopolitan community.

In 2024, Marbella was voted “Best Overall Destination in Europe” by European Best Destinations1 based on over a million traveller votes from 172 countries, a title that highlights the city’s broad appeal and unmatched lifestyle. This followed its earlier recognition as second place winner in the same category in 20222, surpassing Monte Carlo, Capri and other renowned enclaves. Accolades such as these reflect the global spotlight now firmly shining on Marbella as a widely recognised, year-round destination.

Further reading: Marbella Ranks Top 5 in Spain’s Most Searched Areas 2025

World-class luxury hospitality

Marbella’s luxury hospitality offering continues to thrive at the highest level. The Marbella Club Hotel, that celebrated its 70th anniversary in 2024, was awarded two Michelin Keys, the prestigious new distinction introduced by the Michelin Guide to recognise exceptional hotels offering outstanding hospitality.

Further reading: The beginnings of the Marbella Club

In parallel, the Puente Romano Marbella resort has emerged as a culinary epicentre of the Costa del Sol, hosting over 20 restaurants, including world-renowned names such as Cipriani, Nobu, Coya and Gaia. The opening of El Pimpi in May 2024, led by part-owner Antonio Banderas, added a touch of Andalusian authenticity and celebrity glamour to an already glittering scene.

Marbella has become a gastronomic powerhouse, with multiple Michelin-starred establishments such as Skina, Messina, Nintai and Back3 and a long list of fine dining experiences that now compete with the best in Europe. In fact, the city’s dining, entertainment, concerts, wellness and fashion offerings are increasingly the reason why visitors transition from holidaymakers to part time, or permanent, residents.

An essential element of this prestige is the city’s large percentage of international residents. As of January 2025, almost one-third of Marbella’s 166,999 officially registered residents are foreigners, according to the Municipal Register of Residents, from 152 different countries.4 To this figure one must add between 75,000 and 100,000 foreigners living in Marbella as residents, or part time tourists living in their own homes in the winter months, as well as those others staying in hotels and rented accommodations, who form the basis of Marbella’s floating “unregistered” population5, reflecting the truly global nature of this community.

As of January 2025, almost one third of Marbella’s 166,999 officially registered residents, according to the Municipal Register of Residents, are foreigners from 152 different countries

Branded residences

The Costa del Sol, with Marbella at its forefront, leads Europe in branded residences6 and is a natural extension of its firmly established identity as a multinational hub for luxury living. Nowhere is this more evident than in Puerto Banús and the surrounding areas, where one can find an extraordinary concentration of prestigious global fashion brands, complemented by an equally impressive array of automotive brands. The presence of these world-recognised names underscores Marbella’s alignment with international standards of excellence and positions the city as an ideal environment for the development of branded real estate projects.

Marbella’s luxury property landscape has been undergoing a seismic shift, driven in part by a wave of high profile branded residence projects. The upcoming Four Seasons Marbella Resort & Private Residences7, designed by Richard Meier, includes a five-star hotel with 80 rooms and 40 suites, 136 private residences and 30 hotel residences consisting of villas, townhouses and apartments divided almost evenly. Starting prices for these properties are yet to be established and will only be announced when the project is officially launched, possibly in the first quarter of 2026, with construction scheduled to start at the beginning of 2027. The Marbella Four Seasons project cements Marbella’s appeal to a global luxury client. Indeed, just the presence of a Four Seasons in Marbella will attract many high-net-worth visitors who have not yet discovered the magic of Marbella.

Further reading: The Four Seasons Marbella Resort

In the area of the Istán Road, adjacent to the highly successful project Epic Marbella by Fendi Casa, there is Design Hills Marbella by Dolce&Gabbana (the highest quality and one of the best positioned projects ever to be offered in Marbella), close by are the striking Karl Lagerfeld Villas with five bespoke homes that merge sustainable materials with high fashion minimalism.8

Further reading: Branded residences in Marbella

Take a look at properties for sale in Epic Marbella & properties for sale in Design Hills Marbella - Design Hills Marbella Development

In Nueva Andalucía, there are eight Versace Villas, spanning 2,000-square-metre plots, with opulent design and five-star service.9 Then you have elite launches such as The Summit Marbella by Elie Saab in Cascada de Camoján, Lamborghini inspired Tierra Viva in Benahavís, and lengthy pipelines including Marea by Missoni at Finca Cortesin, Aida furnished by Bentley, around the corner from Puente Romano, the W Resort Marbella by Marriott, which has been upgraded to one of their ultra luxury brands, either a St. Regis or Ritz-Carlton10, and Angsana Residences at Real de la Quinta.

Further reading: Properties for sale in Tierra Viva development

Simultaneously, the resale market has shattered records. Villas in Sierra Blanca and Cascada de Camoján now command prices that rival Europe’s most exclusive addresses, and include four of the ten most expensive residential streets in all of Spain. A fifth most expensive area included in this category is Coto La Zagaleta in Benahavís, part of the greater Marbella residential real estate market, and without a doubt, the most exclusive country club in Europe.11

Just the presence of a Four Seasons in Marbella will attract many high-net-worth visitors who have not yet discovered the magic of Marbella

Tourism: a year-round engine of growth

Tourism has always been the driving force behind Marbella’s international success, not only as an economic driver, but as a powerful introducer of the city to the world’s most discerning travellers.

Of particular significance is the presence of residential tourism, the trend of international visitors acquiring second homes not only for holidays, but for extended seasonal stays or part-time living. This movement began in Marbella in the 1950s, when visionary figures such as Ricardo Soriano, Marquis of Ivanrey, and his nephew Prince Alfonso von Hohenlohe introduced the town to a selective global audience, setting the standards for low-rise, low-density development and ensuring, together with the other “founders” of the city, that Marbella would never become overdeveloped like many other resort destinations in the Mediterranean Basin. Over time, what began as an elite holiday destination evolved into a form of long-term investment, rooted in quality of life, security, climate and cosmopolitan appeal. Today, residential tourism remains one of the most influential forces shaping Marbella’s urban growth, economy, and real estate market.

Record-setting number of visitors

In 2024, Spain welcomed a record-setting 94 million international tourists, the highest ever recorded – an increase of approximately 10 percent over 2023’s 83.5 million arrivals12 surpassing even the pre-pandemic benchmark of 2019.

In 2025 this strong upward trajectory continued. By the end of June, 2025 over 52 million international travellers had visited Spain, a 6.4 % increase over the first half of the previous year, with projections pointing to nearly 100 million arrivals by the end of 2025.13

As far as hotel-based tourism in Marbella is concerned, 2024 closed with record local tourism with the best hotel occupation and hotel profits in its history.14

While the first half of 2025 saw a slight dip in overall tourism to Marbella, due principally to fewer domestic visitors15, a strong recovery in July, with 85,697 visitors, up by 11.9% from July 2024, underscores Marbella’s enduring appeal to international tourists.

In August 2025, however, Marbella hotels reached a new, historical high in hotel profitability with a 32% growth in two years, and a 15% increase in job creation and a 5.5% increase in occupation compared to 2024.16

There were also 89 hotels of all categories open in Marbella in the summer of 2025, 20 more than in 2024. Both these facts reaffirm the overall strength of Marbella as a very strong tourist destination.17

Tourism in Marbella is no longer merely a summer phenomenon but is gradually spreading throughout the entire year, a trend that is also beginning to take shape across other resort cities in the Mediterranean Basin. This underscores what is already abundantly clear to those of us that live here: Marbella is not experiencing overtourism, unlike many larger cities in Spain and around Europe.18

As Mayor Ángeles Muñoz affirmed recently, “We are focused on consolidating a model that prioritises quality over quantity, and where the concept of luxury is a differentiator, offering visitors an exceptional experience in a unique location.”

This strategic vision continues to strengthen Marbella’s positioning as a world-class destination, with tourism serving as both a key economic engine and a gateway to long-term residential investment.19

Today, residential tourism remains one of the most influential forces shaping Marbella’s urban growth, economy, and real estate market

Airport accessibility

No luxury destination can thrive without first-class accessibility, and Marbella’s continued success as a global residential resort, together with that of the entire Costa del Sol, is inextricably linked to the exceptional performance of Málaga Airport, the region’s primary gateway. In 2024, Málaga Airport broke all previous records, with 24,923,774 travellers, 174,915 flights, and an amazing 155 direct destinations.20

In the first half of 2025 a record number of 11,494,109 passengers were registered – bringing the airport closer to its estimated maximum capacity of 30 million passengers per year. This exponential growth reflects both increased connectivity and the surging global interest in southern Spain.

The airport set a new benchmark this summer, with up to 60 private flights a day. The remarkable rise of executive aviation reflects not only the influx of high-net-worth holidaymakers, but also a growing number of business travellers drawn by the region’s dynamic economy21.

Together, these factors reinforce the Costa del Sol’s position as one of Europe’s most prestigious and accessible destinations.

Plans are already underway for a major expansion of the airport’s capacity by the end of the decade as elaborated in a later section of this report.

Airport services

In 2024, a new suite of VIP services was introduced by Ambaar Lounge in Terminal 3, including private check-in, fast-track security, luxury lounge access, and direct transfer to aircraft.

Málaga Airport is also set to pioneer Spain’s first electric drone air-taxi service, connecting passengers to nearby areas such as Granada and Marbella.22

The aircraft will initially be flown by pilots, with autonomous operations planned for the future. A 15-20 minute route to Marbella is scheduled for 2030, pending technological and regulatory advancements.

Further reading: Málaga-Costa del Sol Airport Expansion & Drone‑Taxis

The increase in direct flights from the United States, Canada and the five different cities of the Middle East has also played a significant role in opening up Marbella to new, high-net-worth markets.

North American tourism, once limited and seasonal, has become more consistent, thanks in part to targeted promotions and Marbella’s strategic alignment with luxury travel networks.

Lifestyle: the real wealth of Marbella

With so much investment on all levels, Marbella has become a very wealthy city. Yet, an important part of the real wealth of Marbella is not just material, but a result of the innumerable different types of lifestyles available, and especially the outstanding example (among many notable failures in Europe) of a multicultural society where so many people from so many different nationalities are living together in harmony.

As our Mayor, Ángeles Muñoz, recently stated, “Marbella distinguishes itself from other resort destinations by offering a one-of-a-kind blend of world-class hotels, residential properties, services and facilities, solidifying our position as one of the most significant resort cities in the world”.23

Marbella also continues to attract creatives, designers, chefs and lifestyle trendsetters, many of whom are inspired not only by the natural beauty of the region, but by the exceptional quality of its light, architecture as well as its growing cultural atmosphere.

This unique energy is one of the hidden drivers behind Marbella’s growing lifestyle economy.

Marbella’s lifestyle offers freedom of movement, closeness to nature and a profound sense of well-being, qualities now more sought-after than ever before in the post-pandemic world.

The result is a city that provides something increasingly rare: a complete lifestyle, where leisure, business, family, wellbeing and personal growth intersect seamlessly.

North American tourism, once limited and seasonal, has become more consistent, thanks in part to targeted promotions and Marbella’s strategic alignment with luxury travel networks

Key property market indicators

The Marbella real estate market has entered a new phase, one that is defined not by short-term booms or speculative cycles, but by long-term structural strength.

The period following the pandemic might have set new records, but what has followed is even more remarkable: a high-level market characterised by robust demand, limited supply, and increasingly discerning buyers.

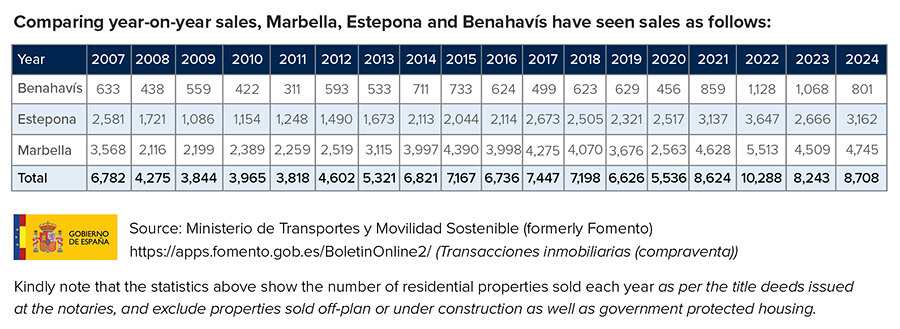

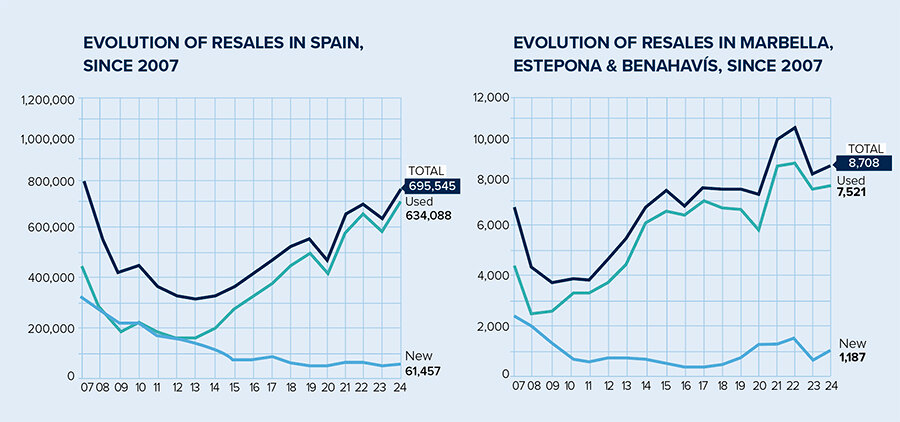

In 2024 a total of 695,545 property sales were registered across Spain, an increase of 8.9% over 2023, with foreigners representing around 14.5% of the total. In the “Golden Triangle” 2024 closed with 8,708 property sales: Marbella recording 4,745 transactions, Estepona 3,162, and Benahavís 801, as reflected in the above table. This shows a healthy increase of 5.65% over 2023, and a 31.42% increase over the pre-pandemic year of 2019.24

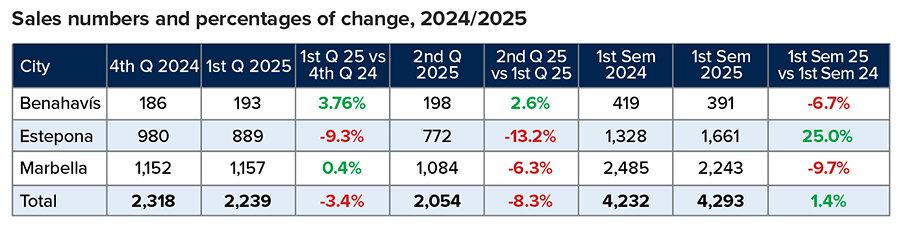

The first semester of 2025 (statistics available at the date of publication of this report)25, for the three municipalities has shown interesting market movement, and is almost exactly on the same sales level for the first half of the year compared with the same period in 2024, at a total of 4,293 sales in the first half of 2025 versus 4,232 last year.

The first quarter of 2025 also showed a sales level similar to that of the last quarter of 2024, with the total of Marbella, Benahavís and Estepona sales descending an insignificant 3.4% from the prior quarter.

In the second quarter (provisional statistics), the sales in the three municipalities descended by 8.3% compared with the first quarter, with Estepona leading the drop of 13.2%, followed by Marbella at 6.3% and a slight improvement in sales in Benahavís of 2.6%.

Overall, sales numbers and percentages of change are summarised in the table below.

The drop in sales in the second quarter of 2025 in Marbella and Estepona is a clear indication that the market is levelling out, a natural and expected result of the historic surge in sales in the post pandemic year of 2022. A contributing factor is that the strong demand in prior quarters has no doubt absorbed, for the moment, the best (and most reasonably priced) properties on the market.

The Marbella real estate market has entered a new phase, one that is defined not by short-term booms or speculative cycles, but by long-term structural strength

Evidence to this is a report by Idealista, Spain’s most important property portal, on June 30, 2025 which stated that the number of homes for sale across the country dropped by 20%, year on year, the biggest drop that they have ever recorded.26 This drop is especially applicable to the Marbella area market due to the intense international demand in the area.

It is logical to conclude that the shortage of properties for sale is making it more difficult for buyers to find the exact property they want at the price they want to pay for it. This lack of product has resulted in some signs of buyer resistance noted, especially from the second quarter of 2025. Agents and lawyers are reporting that although the market, especially the prime, luxury market, is still strong, with a good rhythm of sales, viewings and enquiries on about the same level as 2024, buyers are taking longer times for decision-making, negotiations are more complicated and drawn-out, and there is greater scrutiny of all details, including construction quality with new or refurbished properties, than in the past.

The severe shortage of properties for sale is led by new builds as well as properties in all categories, both nationally as well as locally. Of the 695,545 property sales in Spain in 2024, only 61,457 (just 8.83%) were new-builds as per the graphs above. Compared with 20 years ago, in 2005, for example, there were approximately 306,000 sales of newly-built properties, over five and a half times the volume of new-builds today.27

This stark decline highlights a deep and ongoing structural shortage in new housing supply both nationally and locally as well as a post-2008 market over-correction, with new-build activity yet to recover to pre-bubble levels.

In Marbella, Estepona and Benahavís, newly-built properties in 2024 accounted for just 13.63% of all sales in the region. Within this, newly-built properties in Marbella registered only 7.94% of sales, Estepona new-build properties 22.99%, and Benahavís new properties 10.36%.28 A major limiting factor in this sense is the scarcity of building plots in the area’s most desirable residential areas. One should always bear in mind that newly-built properties are only recorded when the title deeds are issued, and most of them will likely have been sold by private contract months or years before, thereby distorting the real sales figures for the period under examination.

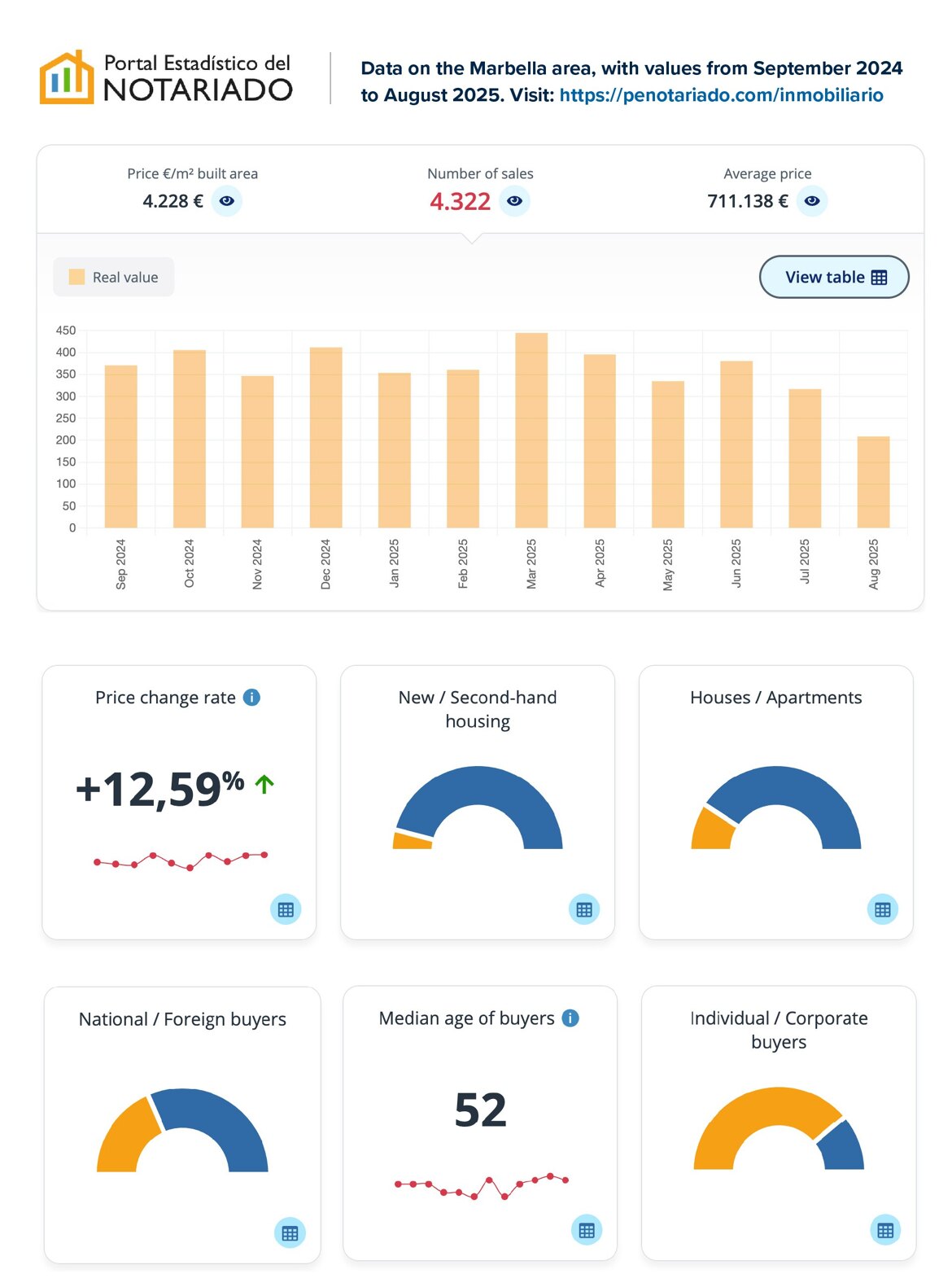

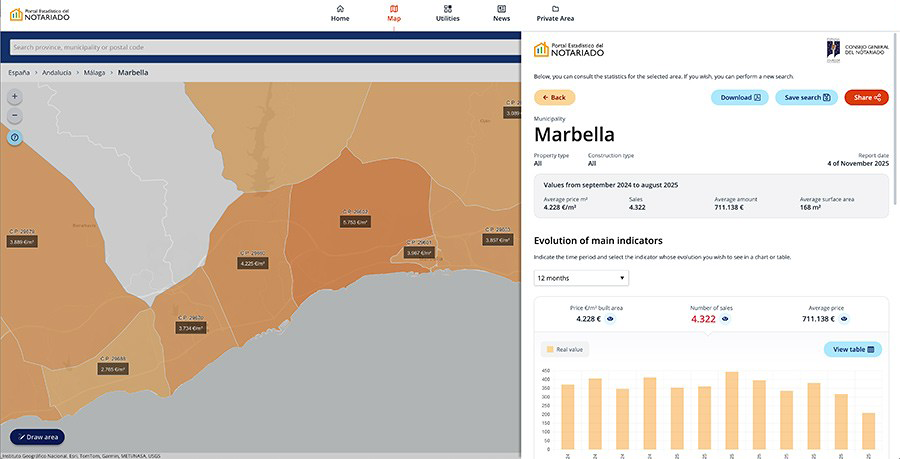

Real, verified prices from the new Notarial Housing Portal

The big news for this year is the creation of a new official portal developed by the notaries of Spain, the Portal Estadistico del Notariado29, offering information on the real estate market for the first time on a municipal level, based on actual sale prices and further data recorded in notarial deeds. This information, up until now, has been available only on a national, regional and provincial level, and it provides much more than just prices. This free public tool provides detailed information that now allows buyers, sellers, investors and property developers to make decisions with far greater accuracy, security, and transparency.

This is something that Panorama has petitioned for over many years, and it is exciting to see this portal finally become a reality.

According to this new official source, the average real sale price per square metre in Marbella in the twelve months prior to September 2025, was €4,228 with the average price of €4,509 per square metre from July to September, 2025 and an increase in average prices in the whole municipality in 2024 of 12.59%. These are real transaction values, not asking prices, and therefore provide a far more accurate picture of what buyers are actually paying in the marketplace.

By comparison, data from the well-known listing portal Idealista, which served as an excellent guide until now, indicated average asking prices of around €5,400 per square metre in Marbella in September 202530.

Of course, the prices indicated in Idealista and other property portals are only as good as their own database of asking prices for properties in each area. The Notarial Portal now bridges this gap by publishing verified, deed-based data at the municipal level for the first time in Spain.

The new portal features interactive maps and statistical dashboards that display national, regional provincial and municipal data, as well as each postcode area, and allows users to filter by property type, size, and transaction volume. All figures are drawn directly from notarised deeds of sale, aggregated and updated regularly, offering a reliable and transparent overview of real market activity.

For Marbella and the Costa del Sol, and indeed, throughout the country, this portal represents a major step forward. For the first time, agents, developers, and analysts can base their assessments on actual average prices, what buyers truly pay, and much more detailed information about buyers than ever before, resulting in more accurate valuations, more preciser pricing strategies, and better-informed decisions for all participants in the market.

This new level of transparency marks an important milestone for the Spanish real estate sector. Examples of the type of additional, valuable information provided by the new portal for the year up to September, 2025 are as follows:

- Average age of buyers in Marbella: 52

- Percentage of buyers between 41 and 60: 54% (and further breakdown in accordance with age)

- Average sales price throughout Marbella: €711,138 (national average is €210,361)

- Average price on the Golden Mile (postcode 29602): € 1,085,457

- Average size of property sold: 168 m2 (national average is 113 m2)

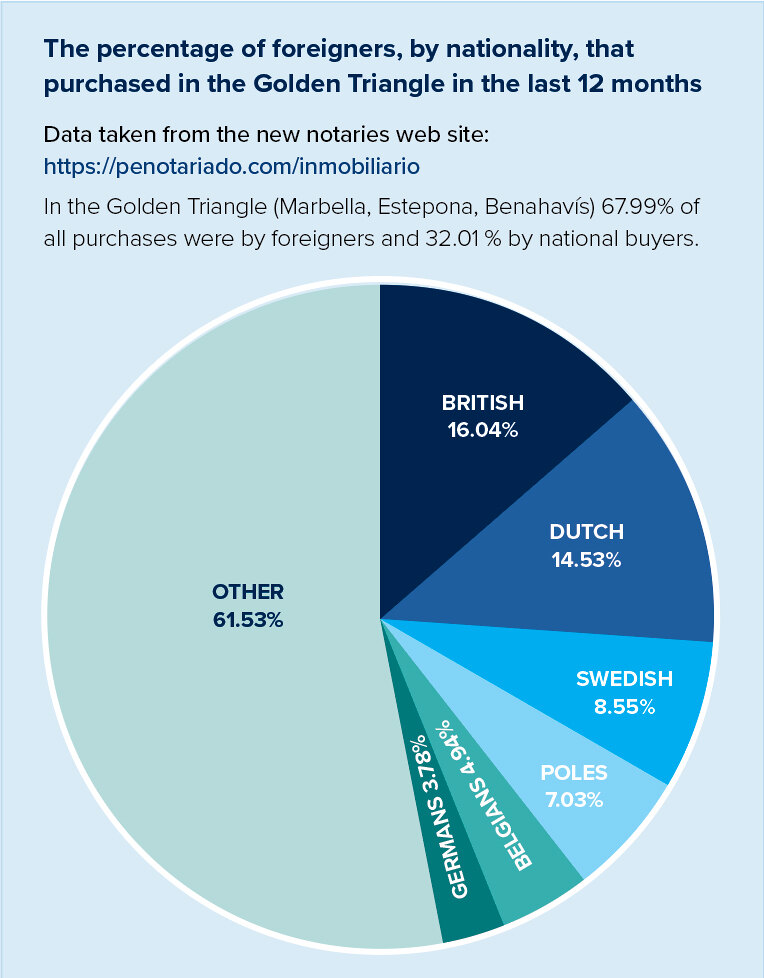

- Percentage of foreign buyers across the Marbella market: 63.14%

- Percentage of purchases made by physical people as compared to companies; 77.75%

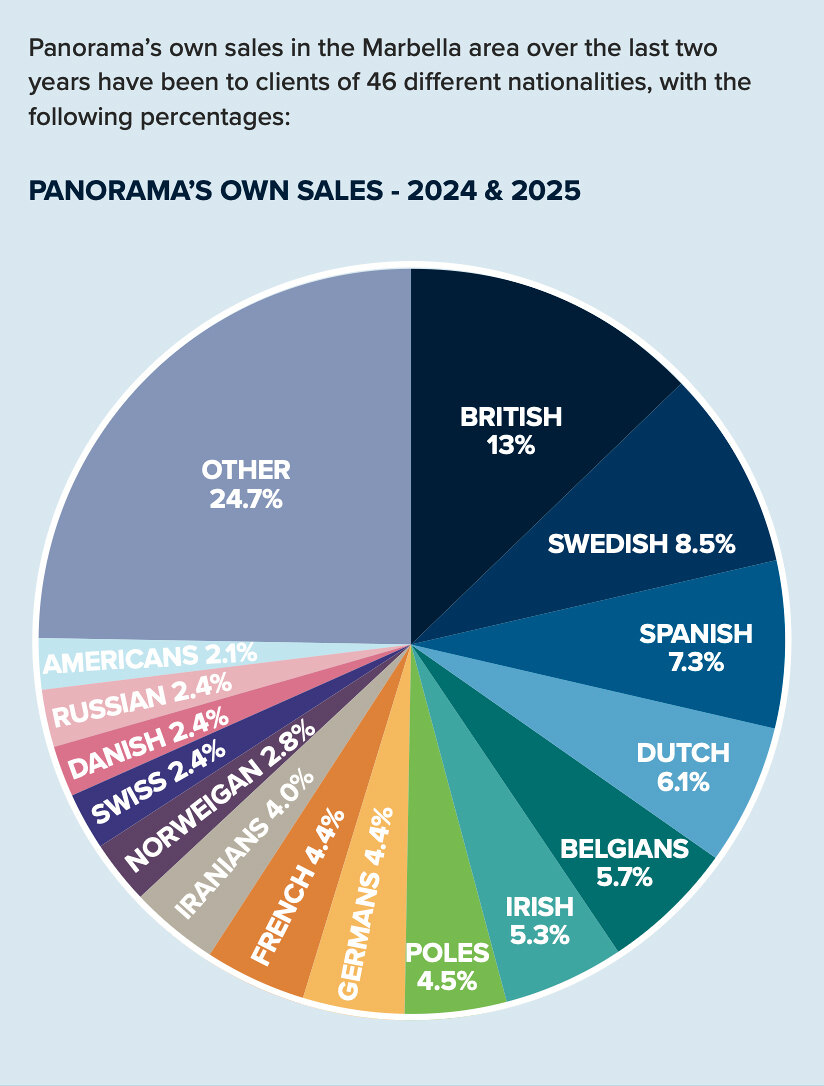

- Nationalities of foreign buyers (see pie chart below for average Marbella, Estepona, Benahavís)

- Surprise leading nationality of foreign purchasers in Estepona is the Dutch!

- The nationality section divides resident and non-resident foreigners as separate percentages of the whole.

- Distinguishing between new and resale properties as well as villas and apartments.

Never before have we had access to such precise market information, even broken down by postcode within each municipality. This new level of transparency represents a remarkable step forward, the result of the excellent work of Spain’s Notarial Council, marking a clear turning point in the availability of real estate data in the country.

Resale asking prices sometimes overly optimistic

Due to the strong price increases of recent years and the consequent position of the market as a “sellers’ market”, coupled with the difficulty in finding reliable statistics with regard to real sales prices, until the 23rd October 2025 when the Notarial Statistic Portal was launched, some owners are listing their properties at overly ambitious prices.

Some have gone too far, pricing their properties at a level that doesn’t even entice viewings.

This imbalance tends to correct itself over time, as owners come to terms with the fact that while the market remains healthy it may not align with their expectations. Or with what they might have been led to believe by some agents more eager to secure the listing than to offer accurate guidance on real market value.

Sellers who want to ensure their properties get great market exposure and regular viewings should concentrate on pricing their properties realistically.

Further reading: Sell your Marbella Property with Panorama

The key for both sellers and buyers seeking to understand real market value is to work with an agent who has the experience and knowledge to demonstrate real selling prices per square metre of comparable properties. This is the only reliable and objective method for determining current market value.

Further reading: Buyer's guide - Seller's guide

The only reliable and objective method for determining current market value is to demonstrate real selling prices per square metre of comparable properties

Will prices continue to rise?

In one word, yes, but probably in more moderation. Both in the luxury segment and across all levels of the residential and commercial sectors, including all land categories. And this trend is expected to continue for the foreseeable future for a variety of reasons:

With respect to luxury properties priced between €2 million and €20 million or more:

- The historic demand for properties in the luxury end of the market has reached new levels driven by high-net-worth and ultra-high net worth buyers.

- The supply remains far below current demand, which continues to drive prices upwards.

- The well-known lack of zoned construction parcels in prime areas, with steep price increases for those available for sale.

- The surging cost of construction, construction materials, and severe shortfall of specialised labour.34

- The expansion of the luxury market for real estate worldwide due to a growing number of high-net-worth individuals and rising disposable incomes.35

- Changing perceptions of the home as both a sanctuary and workspace. The pandemic reshaped priorities with outdoor areas, home offices and flexible layouts becoming essential.

- Investors are continuing to expand their portfolios with high-end real estate in prime areas around the world.36

- Even with price increases, Marbella prime property remains highly competitive compared with properties in Dubai or Miami or luxury properties for sale around the Mediterranean Basin.37

Further reading: luxury properties in Marbella

Properties below €2 million will also increase in price for many of the same reasons. Especially the demand exceeding the very limited supply, rising construction costs, and the easing of interest rates.

Finally, although prices are expected to continue to rise, we anticipate that given the sharp increases since the pandemic and the stabilisation of sales volume, price growth over the next year will most likely be more moderate.

Although prices are expected to continue to rise, we anticipate that given the sharp increases since the pandemic and the stabilisation of sales volume, price growth over the next year will most likely be more moderate

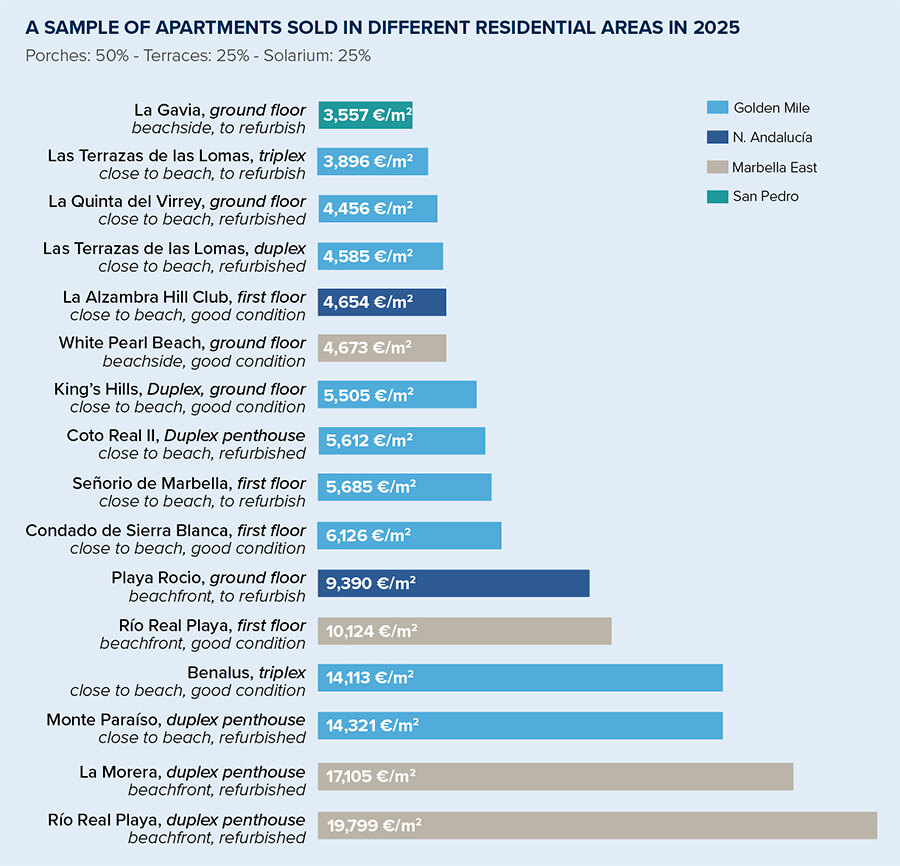

Real market evidence

Real market evidence of square metre prices achieved

To compliment the new price information from the Notary website, Panorama has compiled its own statistics based on real sales prices completed in the last months of 2024 and first eight months of 2025, offering a clear picture of the achieved sales prices per square metre across different residential areas of Marbella.

RESALE APARTMENTS

In our latest review of selected resale apartments (excluding those located within Puente Romano or off-plan properties), several noteworthy trends stand out.

- The appeal of Marbella East

In the highest priced properties, we find the examples of exquisitely renovated, furnished, and decorated frontline beach apartments in East Marbella. At the high end of our survey, one such apartment achieved a record resale price of almost €20,000 per square metre, a new benchmark in this area.

The second and fifth most expensive on the chart also belong to properties in the same eastern region of Marbella, closer to the town centre, which fetched €17,000 and €10,000 per square metre, respectively.

These results highlight the increasing appeal of East Marbella among investors targeting high-end renovation projects. In last year’s report, this ranking was dominated by properties in Estepona’s “New Golden Mile,” Puerto Banús, and the Golden Mile itself. - Perfect penthouses

The third and fourth most expensive properties are luxurious duplex and triplex penthouses, located in sought-after Golden Mile developments such as Monte Paraíso and the recently completed (2023) Benalús complex reaching resale prices over €14,000 per square metre.

The latter has seen a substantial increase in value, owing largely to its strategic location and the fact that it is near some of Marbella’s most desirable new developments, including Design Hills Marbella by Dolce&Gabbana, EPIC Phases I–III and the Karl Lagerfeld Villas. - Golden Mile, still golden

On the other hand, properties in good or original condition, and even some refurbished homes, within consolidated Golden Mile developments like Señorío de Marbella and Coto Real, have maintained similar levels compared to last year, between €5,500 and €6,000 per square metre.

The average price per square metre in the Marbella area, according to Notary website:

According to the Portal Estadístico del Notariado, the price increases in Marbella are as follows:

| Area & sub-area | Avg. price €/m² | Property examples |

|---|---|---|

| Marbella Nagüeles, Golden Mile | €5,753/m² | Nagüeles property Properties in Golden Mile |

| Marbella Nueva Andalucía, Puerto Banús | €4,225/m² | Nueva Andalucía property Puerto Banús property |

| Marbella Town Centre Divina Pastora, Miraflores | €3,967/m² | Marbella Town Centre property |

| Benahavís – | €3,889/m² | Properties in Benahavís |

| Marbella East Río Real, Bahía de Marbella, Altos Los Monteros, Altos Marbella | €3,857/m² | Properties for sale in Marbella East |

| Marbella San Pedro Alcántara & Guadalmina | €3,734/m² | Properties for sale in San Pedro Alcántara Homes in Guadalmina Baja Homes in Guadalmina Alta |

| Estepona – New Golden Mile El Padrón, Mar Azul | €3,520/m² | Properties for sale in Estepona New Golden Mile properties |

| Marbella East El Rosario, Elviria, Marbesa | €3,388/m² | El Rosario properties Properties for sale in Elviria Marbesa properties |

| Estepona – New Golden Mile Benamara, Forest Hills, Alcazaba | €3,122/m² | - |

| Estepona – New Golden Mile Atalaya, El Campanario, Paraíso, Bel Air, Cancelada | €2,765/m² | Properties in Atalaya Properties in El Campanario El Paraíso properties Properties for sale in Bel Air |

| Estepona – New Golden Mile Valle Romano | €2,719/m² | Valle Romano properties |

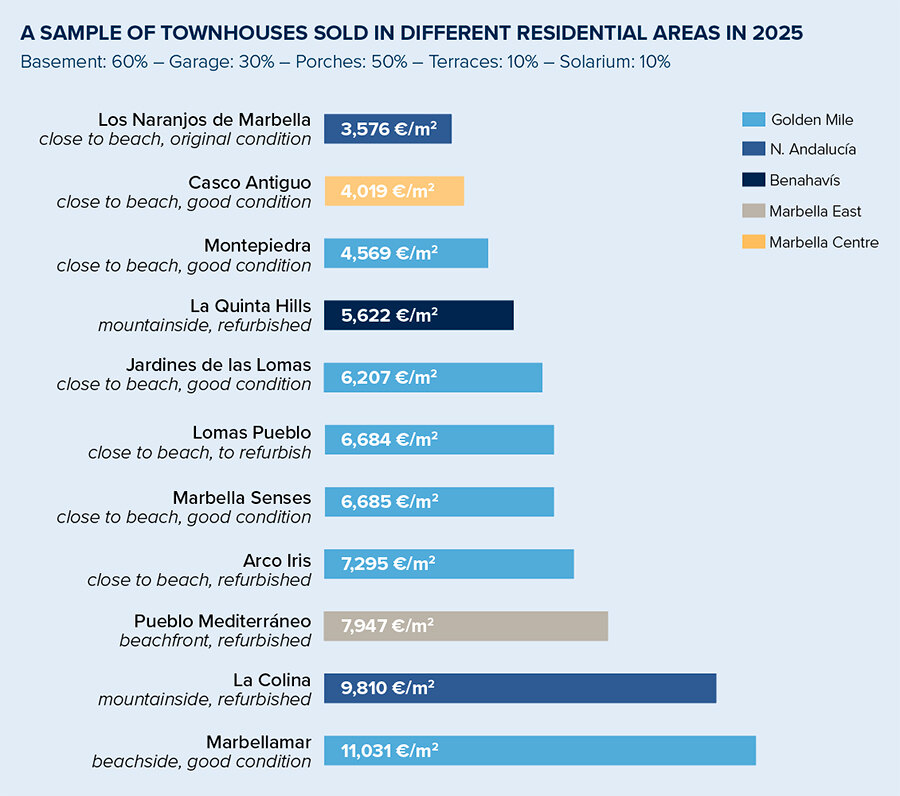

RESALE TOWNHOUSES

Among the higher priced townhouses in our sample study are recently built, or renovated, townhouses such as those in Arco Iris on the Golden Mile (which reached a record price for that complex of €7,295 per square metre), as well as projects like Marbella Senses – also on the Golden Mile – and a frontline beach townhouse in Pueblo Mediterráneo, East Marbella.

Further reading: Townhouses for sale in Marbella East

One of the best-located, beautifully renovated townhouses within the beachside development of Marbellamar, on the Golden Mile midway between Marbella and Puente Romano, reached a price of €11,031 per square metre.

Further reading: Townhouses for sale in Marbellamar

At the top of the list of townhouses, the Golden Mile leads with one of the best-located homes within the beachside development of Marbellamar, midway between Marbella and Puente Romano, reaching a price of €11,031 per square metre

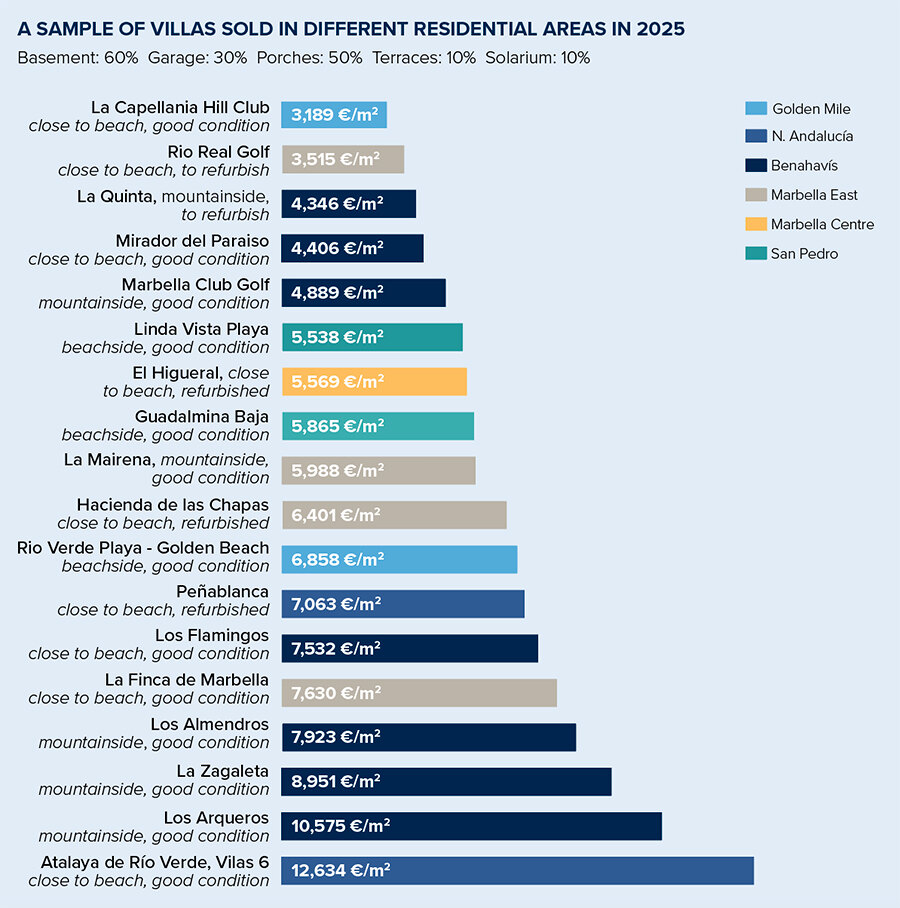

RESALE VILLAS

In our villa sales sample study we included a villa sold in the prestigious Atalaya de Río Verde community adjacent to Nueva Andalucía and another in the community of Los Arqueros in Benahavís.

One was a resale in the recently completed project of semi-detached villas, “Vilas 6,” (we include it here for its villa-like characteristics), reaching €12,634 per square metre.

The other was a villa unique for its location and high position within Los Arqueros with superb views over the golf, mountains and sea, but especially its unusually large plot size of over 4,000 square metres, achieving just over €10,500 per square metre.

Other notable villa sales include those in Benahavís – among them a grand estate with breathtaking views in La Zagaleta and a newly-built home in Los Almendros. These four sales ranged between €7,900 and €12,600 per square metre.

Further reading: La Zagaleta villas for sale.

Interestingly, some smaller villas in Nueva Andalucía have, in some cases, achieved higher prices per square metre than much larger estates elsewhere, due, no doubt, to the enormous popularity of Nueva Andalucía with its strategic location right behind Puerto Banús, and surrounded by Marbella’s best golf courses.

Smaller villas in Nueva Andalucía have, in some cases, achieved higher prices per square metre than much larger estates elsewhere, due, no doubt, to the enormous popularity of Nueva Andalucía with its strategic location right behind Puerto Banús

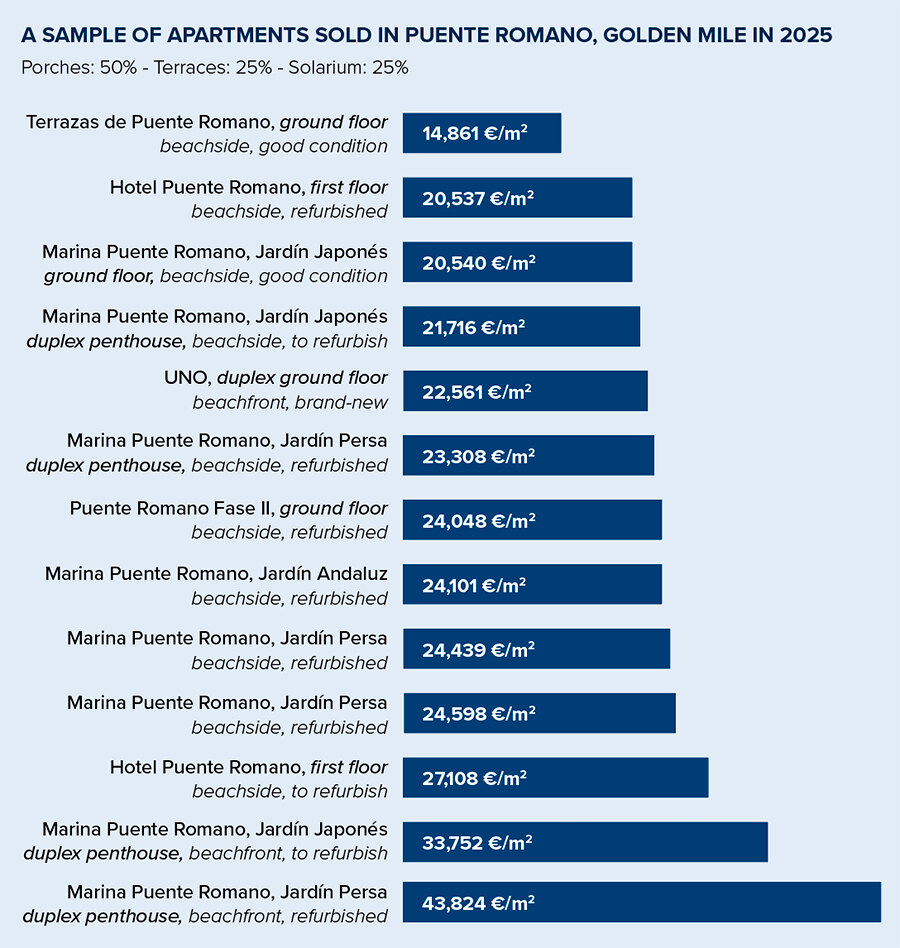

PUENTE ROMANO RESALES: IN A WORLD OF THEIR OWN

There are 400 privately owned apartments, plus the properties of the Puente Romano and Nobu Marbella Hotels, in the area we know as Puente Romano: those in Marina Puente Romano – with its Japanese, Persian and Andalusian Gardens – and the adjacent Las Terrazas de Puente Romano, with 252 apartments altogether, the Puente Romano and Nobu hotel complex, which, in addition to its 287 hotel-owned properties has about 70 privately owned studios or one-bedroom apartments within the hotel complex, and Puente Romano Phase II, just to the east of the hotel, with 78 apartments.

Puente Romano has evolved into a distinct micro-market within Marbella, an ultra-prime enclave where pricing operates in its own world.

Apartment prices in Puente Romano consistently exceed even the most exclusive benchmarks across the Costa del Sol and most of Europe, driven by privileged beachfront access, the unmatched lifestyle offered by being adjacent to the Puente Romano resort and the ultra-prime beachside location midway between Marbella city and Puerto Banús – the heart of the famous Golden Mile.

As of September, 2025, there were 18 apartments for sale in Puente Romano, including ground, middle floor and penthouse units, with asking prices ranging between €2,4 million and €7,5 million.

From August 2024 to August 2025, the average selling price per square metre of fully refurbished properties sold in Puente Romano area, excluding beachfront properties, which are in a different category, was €24,020 per square metre. For properties in need of refurbishment, the price reached was €19,039 per square metre.

Interestingly, just three years ago apartments available for sale in this area could be counted on one hand, but the wave of high-end refurbishments completed over the last two years has slightly outpaced current demand, creating short-term competition among sellers even though the demand for Puente Romano’s ultra-prime properties remains strong.

Even so, record-setting selling prices continue to define this market. One exceptional frontline beach apartment in the Persian Gardens, beautifully furnished and decorated, is reported to have reached almost €44,000 per square metre in March 2025, a price virtually unparalleled on the Spanish mainland and the highest ever recorded within the resort, surpassing last year’s record of €41,695 per square metre.

Across the different complexes within Puente Romano, asking price levels typically range from €14,800 to over €40,000 per square metre, depending on the exact location, orientation, finishes, date and quality of refurbishment, furniture and decoration, and, of course, views.

Currently, none of the small apartments in the original hotel complex of Puente Romano are for sale, and when one does come onto the market, it is usually snapped up in a few days.

Further reading: apartments for sale throughout the Puente Romano area.

Puente Romano has evolved into a distinct micro-market within Marbella, an ultra-prime enclave where pricing operates in its own world

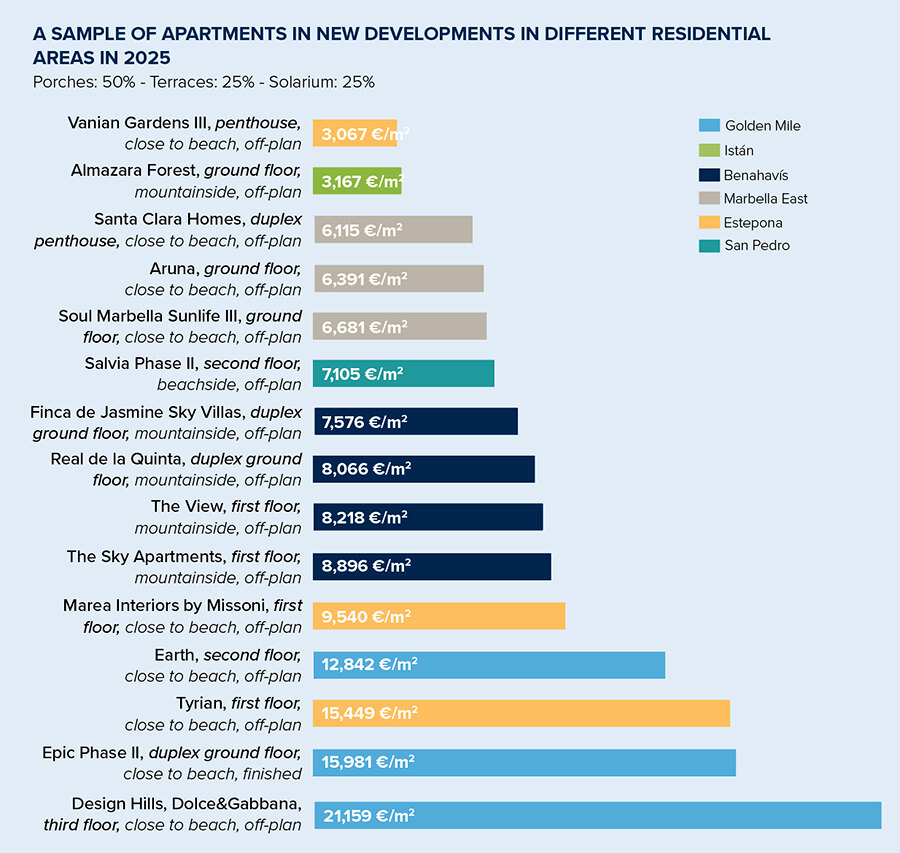

NEW DEVELOPMENTS – APARTMENTS

This section covers both sold and still-available units in new developments, whether off-plan, under construction, or completed.

The properties selected aren’t meant to be compared directly, but instead provide a broader perspective into pricing across various projects, from garden-level apartments to penthouses.

Further reading: New developments for sale in the greater Marbella area

New-build apartments

At the top end, we find branded properties in prime locations such as the Golden Mile with prices ranging between €16,000 and €21,000 per square metre, in frontline beach complexes in Estepona above €15,000 per square metre, or inland, ultra-private estates like Finca Cortesín or Benahavís priced between €7,000 and €10,000 per square metre.

Pricing across these new offerings remains varied, with some projects offering surprisingly competitive prices between €3,000 and €7,000 per square metre, an opportunity that should not be overlooked by savvy investors.

In the townhouse segment, the leading properties include several reserved off-plan units in Nikki Living located in Nueva Andalucía, a new development planned as an aparthotel. Its success is in part due to perfect timing: these properties permit short term rentals, where the owner is restricted to two months personal use and obligated to rent out through the on-site property management team the rest of the year.

This is an attractive proposition for investors who have been affected by the recent limitations on new tourist rental licences implemented on July 1, 2025. Here prices have reached around €10,000 per square metre.

Further reading: Newly built apartments in the greater Marbella area.

Pricing across these new offerings remains varied, with some projects offering surprisingly competitive prices between €3,000 and €7,000 per square metre, an opportunity that should not be overlooked by savvy investors

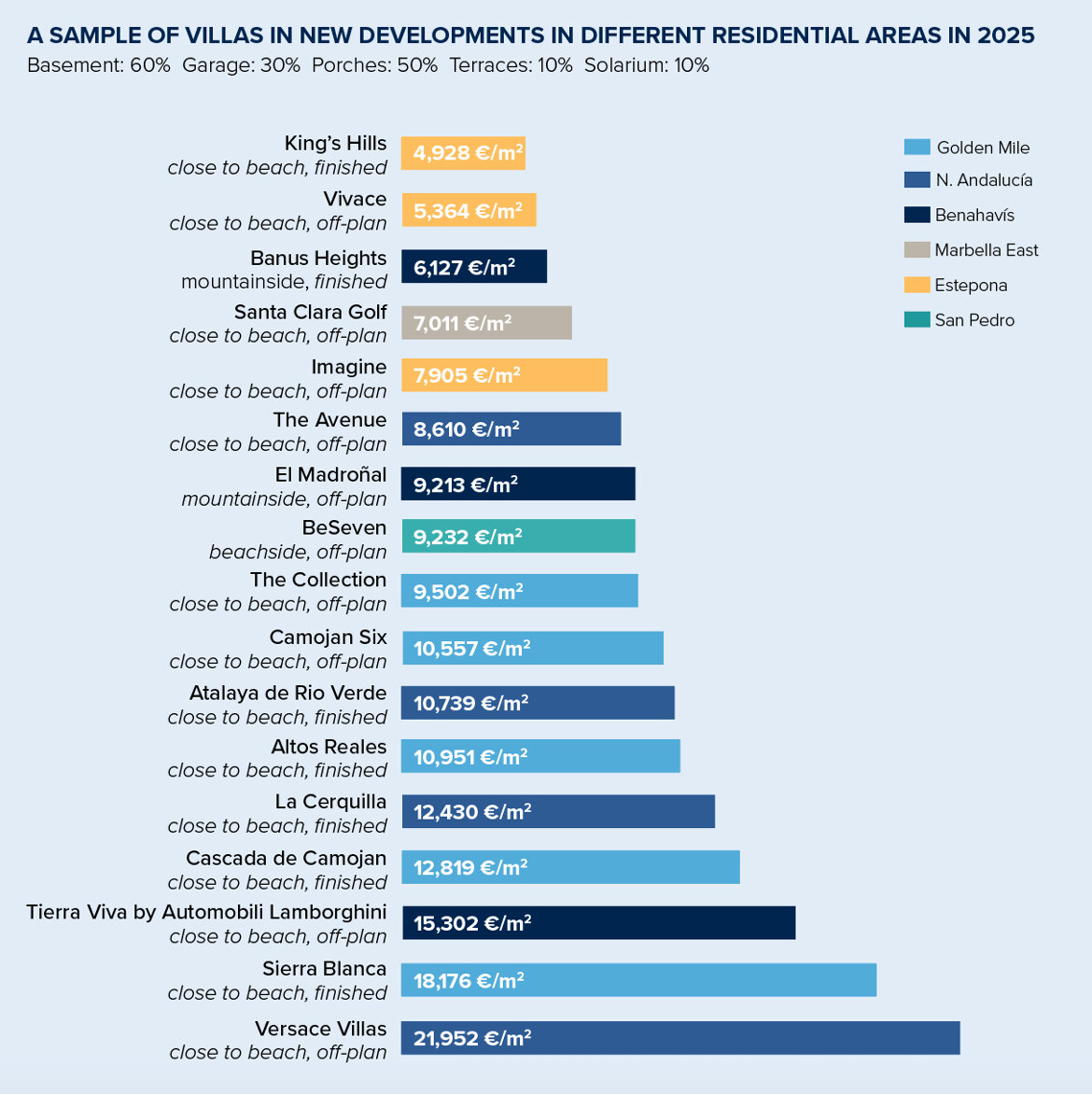

NEW DEVELOPMENTS – VILLAS

Again, branded residences in Marbella and the surroundings dominate the high-end segment of newly-built villas, particularly those that are built on expansive plots. We are now seeing some villas priced above €14,000 per square metre, and even up to €22,000 per square metre, marking a new chapter in Marbella’s luxury real estate prices.

Despite the limited supply, the municipalities of Marbella, Benahavís, and Estepona offer a remarkable diversity of investment opportunities across all property types. The properties being offered today in the luxury category feature great architecture, quality of construction, finishes, and, often, decoration, making them some of the most beautiful homes in the world. Just the availability of these amazing residences is one of the many factors that attract high net worth clients to the area in the first place.

It is precisely in such a dynamic landscape that the role of experienced agencies with real professional credentials that know the market thoroughly becomes critical in finding just the right property for their buyer clients.

Just the availability of these amazing residences is one of the many factors that attract high net worth clients to the area in the first place

Demand at the top end remains unshaken

In the luxury segment, which we define as properties priced over €2 million, both Panorama and other leading agencies report that less than 10% of these purchases involve financing, insulating the market from interest rate fluctuations and reflecting the purchasing power of Marbella’s clientele.

WHO IS BUYING?

In 2024, British, Dutch, and Swedish nationals dominated the foreign buyer landscape in the Málaga province. Collectively, foreigners accounted for 34.75% of all of the property transactions in Málaga in the first quarter of 2025, over two and a half times the percentage of foreigners buying on a national level.38 In Andalucía, the nationality of the foreign purchasers can be seen in the pie chart.

Contrary to initial expectations following Brexit, the British continue to buy properties in the luxury market, although their share continues to diminish year after year

The rental landscape: key trends in 2025

Marbella’s rental market is under intense and sustained pressure, with demand far exceeding supply and prices rising year after year. Both the long-term and short-term rental sectors are feeling the strain, amplified and complicated by increasing government intervention by local, regional, national and European Union governments, with major implications for investors, residents and the local economy.

Long-term rentals: severe shortage and rising prices

The housing crisis in Spain is probably the most severe social issue facing the country today, and Marbella and the Costa del Sol are by no means exempt.

Marbella’s rental market is heavily skewed towards second homes and seasonal properties, creating acute housing shortages for the working and professional community, as it is in most areas of the country. Average long-term rents for an 80 square metre apartment have risen nearly 89% in six years, from €848 (€10.6/m²) in 2019 to €1,600 (€20/m²) in July 2025. Prime areas like the Golden Mile, Nagüeles, Nueva Andalucía, and Marbella East saw annual increases of around 10–11%.39

High costs have driven tenants to surrounding towns such as Ojén, Guaro, Coín and Manilva, where rents are also rising by 15–20% annually. This shortage creates staffing challenges for hospitality, education, healthcare, and many other sectors. Some companies are buying properties to house staff.

The local government is taking measures to encourage new building of affordable housing. One of these measures includes the concessions of municipal land classified as “equipment land” to developers, at no charge, for the construction of affordable housing, with priority for key workers. These and other measures will work in time, but in the meantime, there is upward price pressure on properties for rent just as much as there is on those for sale.

Further reading: Long-term rental properties in Marbella and the surrounding area.

Short-term rentals: regulation and disruption

Since January 2024, sweeping governmental reforms introduced complex compliance requirements. These include Andalusian VUT licensing, the new national NRUA registration, municipal registers, and, since April 2025, homeowners’ community approval for tourist rentals.

As an example of the restrictions imposed by local authorities, Málaga City Council has implemented a three year moratorium on new tourist rental licenses across the municipality. Mayor Francisco de la Torre emphasized that “not one more” tourist property license will be granted during this period. The moratorium will remain in place while the city updates its General Urban Planning Plan (PGOU) to better balance tourism with affordable housing needs.40

In Marbella, most of the properties being rented short-term are to high net worth clients by owners who are using the properties themselves, including a large number of villas, during the months outside the peak season. This is a very different scenario from these big cities where often, the city centre apartments have mostly become short-term rental properties year-round, owned by investors, not end users, driving out the original Spanish owners due to the skyrocketing prices paid by investors. Many of these big cities, not only in Spain but elsewhere in Europe, are suffering from overtourism, which is fortunately not present in Marbella. Therefore, the Marbella Town Hall will not impose limits in any specific area on short-term rentals, although the situation will be “closely monitored” according to the Mayor. As of mid-August 2025, in Málaga province, including Marbella, only 49.6% of the tourist apartments authorised by the Junta de Andalucía were fully registered in the National Unified Tourist Rental Registry (NRUA). When including those still in the process of obtaining provisional authorisation, the figure rises to 65%.41

Further reading: Holiday rental properties in Marbella and the surrounding area.

Homeowners’ community bans on short-term rentals are already resulting in buyers refusing to purchase in some of these communities, thereby lowering the saleability and property values in those communities. On the other hand, some very exclusive communities have, in fact, enhanced their exclusivity by refusing short-term rentals. What is important to note is that there is no guarantee that a community now allowing short-term rentals might, at some future date, prohibit them and vice versa.

In many, if not most cases, instead of a total community ban on short-term rentals, moderate limits (e.g., a minimum of perhaps one week, or even one month stays) could preserve resale values while attracting reliable, quality tenants.

For further information, see the article published by LPA, the Leading Property Agents of Spain.42

Further reading: Christopher Clover, CEO of Panorama named Honorary President of new real estate association, LPA

Proposed VAT increase

A proposed national law seeks to apply a 21% VAT to short-term rentals aiming to shift supply toward long-term rentals. Strongly backed by the hotel industry (who pay 10% VAT but believe that touristic rentals should only pay the same percent tax as they do) the proposed law has sparked strong opposition, particularly from coastal property owners who rent seasonally to cover costs. Critics argue it would harm tourism, unfairly target short-term rentals, and do little to ease the housing crisis. This newly proposed law is still under debate and is unlikely to be approved without important modifications, hinging on coalition support in Spain’s divided parliament and likely amendments due to regional and sector resistance.

Market effects include a shift toward professionalised, hospitality-style management, some owners moving to long-term rentals, and new investors focusing on off-plan purchases for year-round leasing. However, many coastal properties used seasonally by owners were never part of the long-term market, meaning these laws will no doubt reduce short-term supply without easing the housing crisis, impacting tourism and local businesses.

Looking ahead

Marbella has moved from minimal rental regulation to one of the strictest regimes worldwide, creating confusion and added costs.

Current conditions are chaotic, with legal challenges, insufficient knowledge of the new laws by property owners, duplicated regulations and industry protests.

Owners and investors are advised to work with experienced local advisors, monitor community rules, and adopt balanced rental strategies to protect both yields and property values.

EDITOR'S NOTE

Due to the constant evolution and clarification of existing and conflicting parts of the various recent laws involved, please read the latest updates on the rental scenario in Spain and in Marbella.

Other factors affecting the market

What buyers are seeking: a market built on lifestyle and permanence.

Over the past three decades, as Marbella’s “off-season” gained popularity and remote working became more widespread, we have witnessed a clear shift in buyer profile: from traditional holiday-home purchasers to lifestyle-driven buyers seeking a true second home or a permanent residence. These buyers prioritise design, amenities, and services of the highest quality. They are well-informed, discerning, and value privacy, security, and long-term liveability.

Today’s buyers are not simply looking for properties, they are searching for a seamless lifestyle. Among the top priorities:

- Proximity to the beach, golf courses, or nature

- Turnkey or newly refurbished properties with modern amenities

- High-speed internet and office space for remote work

- Gated communities or discreet environments with 24-hour security

- Energy efficiency and sustainable design

- Proximity to international schools, health clinics, and transport links

- Smart homes are no longer considered a luxury, they are seen as a basic necessity.

Buyers in the €2–5 million range or higher are shifting their focus toward long-term residence and integration into the Marbella life. At the upper end — particularly in Puente Romano, La Zagaleta, Sierra Blanca and Cascada de Camoján — the emphasis is on exclusivity, architectural uniqueness, security and concierge-level services.

Further reading: Properties for sale in Puente Romano - La Zagaleta - Sierra Blanca - Cascada de Camoján

Visas and residency opportunities

Spain’s Golden Visa programme officially came to an end on April 3, 2025. For over a decade, the scheme granted residency rights to non-EU citizens investing €500,000 or more in Spanish real estate, helping to position Spain, and Marbella in particular, as an attractive destination for international investors. It facilitated access to the European Union for non-Schengen buyers and provided a steady, if modest, stream of purchasers to the Spanish property market.

The government’s decision to discontinue the programme was driven by the aim of alleviating housing pressures in cities such as Madrid and Barcelona, where speculative purchases linked to the Golden Visa were seen as contributing to rising prices. While the measure may address those urban concerns, its effect in resort markets like Marbella, where demand is primarily lifestyle-driven, is very limited.

Importantly, Spain continues to welcome international residents through the Non-Lucrative Visa, the increasingly popular Digital Nomad Visa, and permits for entrepreneurs and highly qualified professionals, ensuring that residence permits in the country remain accessible even without the Golden Visa.43

Further reading: No golden visa? No problem. Alternative visa options for residency in Spain

Spain continues to welcome international residents through the Non-Lucrative Visa, the increasingly popular Digital Nomad Visa, and permits for entrepreneurs and highly qualified professionals

Proposed Spanish property tax doubling cost for Non-EU buyers faces significant hurdles

On January 13, 2025, Spanish Prime Minister Pedro Sánchez announced a proposal to impose a 100% tax on the taxable base of second-hand (resale) property purchases by non-EU non-residents, aimed to address speculative buying amid Spain’s housing affordability crisis. On May 15 the Socialist-led government submitted the draft law to parliament. Added to existing regional transfer taxes of 7% in Andalucía, this tax would significantly increase costs for affected buyers.

The tax would apply to transfers of real estate ownership or certain real rights (e.g., usufruct, bare ownership) but there are key exemptions, including especially all new properties and other properties subject to VAT rather than transfer tax.

The measure, which reflects the left-wing coalition government’s emphasis on social housing policies to foster alignment with its progressive allies, aims to prioritize housing access for Spanish residents. As of September, 2025, the proposal remains under review with passage uncertain due to the legal and political challenges.

This uncertainty with respect to whether the law will be approved or not, has spurred non-EU buyers to accelerate purchases, particularly of resale properties affected by the proposed law. Amendments or rejection of the law remains probable.

Further reading: Proposals to reform Spain’s housing law

Legal and planning developments

A key factor that separates stable property markets from speculative ones is legal and planning certainty. In this regard, Marbella has made important strides in recent years — laying the groundwork for a more transparent, reliable, and sustainable development model.

The new General Municipal Plan of Marbella

2025 marked a turning point in Marbella’s urban planning journey, with the provisional approval by the Town Hall of the General Plan (PGOM) on July 29, 2025.44

Since the Regional Government’s passing of Law 7 in December, 2021 titled “The Promotion of Territorial Sustainability in Andalusia” (LISTA) the old instrument of the General Urban Planning Plan (PGOU) was replaced by two complementary planning instruments, the PGOM and the POU.

The PGOM is a structural planning instrument that defines the municipality’s general development model, establishing strategic guidelines for the entire area. The POU is a detailed planning instrument that regulates urban land and, where applicable, developable land that has already been transformed, or is in the process of being transformed.

A key factor that separates stable property markets from speculative ones is legal and planning certainty. In this regard, Marbella has made important strides in recent years

The Impact of the LISTA Law

Andalusia’s LISTA law continues to reshape the legal landscape for urban planning across the region. Among its key features:

- Simplification of procedures for obtaining building permits

- Faster approval timelines for urban development projects

- Greater autonomy for municipalities to manage local planning

- Environmental and energy efficiency criteria embedded into the planning process

For Marbella, LISTA has provided the legislative framework to modernise its approach without waiting for full PGOM and POU approval. This has facilitated small- and mid-scale development and renovation projects, while ensuring alignment with broader sustainability goals.

After a decade of uncertainty following the annulment in 2015 of the 2010 PGOU (General Urban Plan), the city continues under the framework of the 1986 Plan, albeit with numerous adaptations, which has allowed the plan to evolve in some respects, along with the city, over time.

The new PGOM should be definitively approved in the first half of 2026. The POU is expected to be approved initially in 202645, with a definitive approval expected between 2027 and 2028.

The PGOM aims to provide a clear, updated vision for Marbella’s future, with emphasis on:

- Sustainable urban growth

- Preservation of green and natural spaces

- Balanced development that meets housing needs without overburdening infrastructure

- Urban regeneration, especially in older neighbourhoods

- Legal regularisation of properties in limbo due to prior planning ambiguities

- A central theme of Marbella’s urban planning evolution is the concept of the “15-minute city” — a model that ensures all essential services (schools, healthcare, shopping, green spaces) are within a 15-minute walk or bike ride.

These new planning instruments reflect a vision of Marbella not as a resort enclave, but as a self-sufficient, inclusive, and resilient Mediterranean city.

A central theme of Marbella’s urban planning evolution is the concept of the “15-minute city”, a model that ensures all essential services are within a 15-minute walk or bike ride

The legalisation of previously irregular properties

One of the most pressing concerns historically in Marbella’s property sector has been the status of properties built under the now-annulled 2010 Plan. In many cases, properties that were granted licences under that framework have remained in legal limbo, creating uncertainty for owners and buyers.

In 2024, local authorities made significant progress toward regularising these properties, allowing them to be fully integrated into the planning system. The use of tools like Declaraciones Responsables Urbanísticas (Urban Responsibility Declarations) and flexible transitional measures has enabled many properties to obtain full legal standing.

Legal certainty drives investor confidence

Perhaps the most important outcome of these planning and legal improvements is renewed confidence in Marbella as a safe and well-regulated place to invest. For many years, questions around planning irregularities dampened activity in certain sectors, but those concerns have now largely subsided.

Developers are once again engaging in long-term planning, international buyers are reassured by the city’s institutional direction, and legal professionals report a notable decline in title-related complications during property transactions.

A booming local economy

The Marbella City Council reported record-breaking economic figures for 202546, with over 83,000 contributors to Social Security and the lowest unemployment rates in recent history. This figure rose to 85,400 contributors by July 31, 2025.

A small town with outsized economic influence, shifting to a varied economic future

An important article written by José Antonio Medina Ibáñez published in the Latin Press on May 25, 202547 discusses the exciting evolution of the Marbella economy: Despite its modest size, Marbella punches far above its weight in the regional economy. With just 9% of the province’s population, it contributes 17% of the province’s 136,848 businesses.

“This significant business presence underscores Marbella’s role as a vibrant economic hub. Marbella is at a pivotal moment in its economic evolution. While high-quality tourism, construction, and real estate remain foundational, the city is in the process of steadily diversifying. Growth in professional, technical, and consulting sectors signals a shift toward a more varied economic future, with these industries poised to play a central role in shaping Marbella’s trajectory.”

Developers are engaging in long-term planning, international buyers are reassured by the city’s institutional direction, and legal professionals report a notable decline in title-related complications during property transactions

Infrastructure, sustainability, and urban planning

A great city is more than its homes, it is defined by the quality of its infrastructure, the foresight of its planning, and the harmony between urban life and the natural environment. Marbella has reached a point in its evolution where the demand for world-class real estate must be matched by intelligent, moderate and sustainable growth, along with a world-class infrastructure. Although there is a lot of work to be done, the city is meeting this challenge with determination and vision.

A commitment to world-class infrastructure

In recent years, Marbella has undertaken several major infrastructure projects designed to improve the overall urban experience. Among the most notable:

- Pressure is mounting to eliminate tolls on the AP-7 motorway between Fuengirola and Sotogrande, a measure that would relieve strain on the coastal N-340 road. Although our direct, political sources inform us that this does not seem possible under the current national government, every effort should be made to continue to apply maximum pressure since the removal of this toll is the one factor which will substantially relieve congestion on the main coastal highway.

- The local government is already implementing practical solutions, such as the expansion of a third lane between Puerto Banús and San Pedro, aimed at reducing bottlenecks during peak hours. The rebuilding and widening of the beginning of the road to Istan, the remodelling of Avenida del Trapiche, the expansion of cycling lanes and pedestrian walkways, are typical examples of the dozens of municipal infrastructure projects going on throughout Marbella. There are precisely 15 specific, important projects underway involving improvement of circulation within the municipality.48

- There is renewed political and public support for extending the coastal train line from Fuengirola to Marbella and Estepona, and eventually all the way to Algeciras. Marbella remains the only city in Spain with over 160,000 inhabitants without a train connection, a discrepancy that is widely recognised and actively being addressed. In May, 2025 funds were approved by the Ministry of Transportation to go to tender for a new study which will set objectives and map out alternatives.49

- Málaga airport Extension: as the Costa del Sol continues to attract residents and investors from around the globe, ease of access becomes an indispensable factor. The surge in air traffic and proximity to the estimated limit of maximum number of travellers, has prompted the airport authority, AENA, to make plans for a new airport extension. On July 22, 2025 AENA announced that it is formally putting out to tender the project for almost doubling the size of the Málaga Airport, with the extension scheduled to be built starting in 2027 and finishing in 2031.50

Further reading: Málaga-Costa del Sol Airport Expansion & Drone‑Taxis

“The city is in the process of steadily diversifying. Growth in professional, technical, and consulting sectors signals a shift toward a more varied economic future...”

Water Scarcity

Although 2025 brought much-needed rainfall, water scarcity remains one of the most critical issues for the Costa del Sol. Fortunately, decisive steps are being taken to lessen dependence on traditional reservoirs.

The expansion of the Marbella desalination plant now enables it to produce double its former capacity, providing nearly one third of the water needed for the entire Costa del Sol, while simultaneously improving the efficiency of adjacent treatment plants that also process water from the La Concepción reservoir.51

Additional projects include a planned water treatment facility for Mijas, Fuengirola and Torremolinos; the expanded use of reclaimed water; and the renewal of dozens of municipal wells to reinforce supply, particularly for public gardens.

Estepona, in parallel, is on the verge of completing its own desalination plant, a pioneering, containerised facility powered by solar energy and designed to ensure near self-sufficiency in water supply for the municipality.

Estepona is on the verge of completing its own desalination plant, a pioneering, containerised facility powered by solar energy

These advances are of profound importance for the property market, as the assurance of a sustainable and reliable water supply underpins the long-term growth and resilience of the Costa del Sol — essential both for residents’ quality of life and for maintaining international confidence in Marbella.52

PUBLIC AND PRIVATE INVESTMENT IN MARBELLA

One of the strongest indicators of Marbella’s economic vitality is the scale and diversity of investment currently flowing into the city, both from public institutions and private enterprise. These investments signal more than capital expenditure, they reflect profound confidence in Marbella’s future.

Public sector investment: building for quality of life

The Marbella City Council, with a municipal budget in 2025 of €405,260,000 has outlined a capital investment plan focused primarily on mobility, sustainability, and civic improvement.53

Key to this plan is the enhancement of Marbella’s green infrastructure, with new public parks and reforested urban areas aiming to reduce heat-island effects and improve environmental quality.

Cultural and educational facilities are also seeing renewed attention, with the modernisation of municipal libraries, the continued rehabilitation of Marbella’s historic Old Town, and a long-awaited expansion of the Hospital Costa del Sol. Financed in collaboration with the Andalusian regional government and due for completion by 2028, this expansion will enhance the healthcare capacity for residents and visitors alike.

Private sector momentum: luxury real estate, hospitality and health

On the private side, investment continues at an unprecedented scale, particularly in the luxury real estate and hospitality sectors. The hospitality sector, long a cornerstone of Marbella’s global appeal, is undergoing a renaissance. Over €250 million has been committed to new or extensive renovation of the five-star hotels across Marbella and its immediate surroundings.54

Notable examples include the relaunch of the historic La Fonda Hotel under the Relais & Châteaux brand, the transformation of beachside hotels such as Los Monteros and El Fuerte, and new boutique concepts designed for high-end experiential travel.

Private investment is also flowing into healthcare and education, two pillars of Marbella’s infrastructure that are essential to attracting long-term residents. Several new international schools are being planned and many of the existing will be expanded.

Leading private clinics, particularly those specialising in wellness and longevity, are opening branches in the city, anticipating growing demand among affluent, health-conscious residents from across Europe and the Middle East, adding to the 20 hospitals and clinics already established within the municipality.

Further reading: Healthcare on the Costa del Sol: The best in the world on your doorstep

Key to Marbella’s capital investment plan is the enhancement of Marbella’s green infrastructure, with new public parks and reforested urban areas aiming to reduce heat-island effects and improve environmental quality

Looking forward

The message is both clear and inspiring: Marbella is thriving, not as a trend, but as a way of life. Billions of euros have been invested in Marbella. It has become a global benchmark for lifestyle-oriented living and one of the most exclusive resort cities in the world. Marbella has matured, evolving into a long-term safe haven for capital, lifestyle, and legacy.

We believe greater focus, increased investment and attention to infrastructure, cleanliness, and all public services are absolutely critical in order to meet the very high standards expected of a leading global destination

- The groundwork being laid today will ensure that the city continues to thrive, not only as a luxury destination but as a living model of what modern, human-centred development can look like.

- For the discerning buyer or investor, this evolution adds depth to Marbella’s value proposition. It is no longer just about sea views or square metres; it is about being part of a city that is building for the future and in the process of exciting, natural diversification of its economy to include professional, technical, and consulting sectors signalling a shift toward a more varied economic future outside the foundations of the hospitality and the real estate sectors.

- Challenges remain: Marbella’s well-earned title as Europe’s Best Destination in 2024 reflects its remarkable appeal, with both public and private sectors making notable strides to support this success, as outlined earlier. To fully live up to this prestigious accolade, Marbella must prioritise even more achieving a world-class level infrastructure and municipal services. While commendable efforts are underway, we believe greater focus, increased investment and attention to infrastructure, cleanliness, municipal gardens, and all public services are absolutely critical in order to meet the very high standards expected of a leading global destination. Sustained commitment to these priorities will ensure that Marbella will continue its positive evolution.

- Policy clarity around the rental market is crucial to protect both yields and values, while the chronic shortage of supply demands pragmatic planning and professional execution. These are all solvable issues, but they require ambition, coordination, and follow-through from both public and private sectors.

- The Marbella-area real estate market continues to demonstrate resilience, driven by strong international demand, its exceptional lifestyle appeal, and a robust economic foundation. However, the official statistics, as discussed earlier, added to feedback from agents indicate sales volume, especially in the luxury category, aligning with 2024 levels, with buyers exhibiting greater discernment, taking longer to make decisions, and negotiating more assertively.

Marbella is poised to remain a sellers’ market for several years ahead, underpinned by limited supply and enduring global appeal

Additionally, a modest uptick in available resale properties in ultra-prime areas like Puente Romano, combined with the various issues of the evolving regulations impacting short-term rentals, suggests the market is now entering a phase of consolidation, a natural progression following the unprecedented post-pandemic activity.

This market maturation reflects a sophisticated buyer base, prioritising value and sustainability, which supports long-term growth. Marbella is poised to remain a sellers’ market for several years ahead, underpinned by limited supply and enduring global appeal, cementing its position as a premier destination for discerning investors and residents.

Far beyond luxury real estate, Marbella’s true foundations and real wealth extend beyond the material. They encompass a richness of experience, culture, health and community. And it is this unique energy that drives, and will continue to drive, Marbella’s growing lifestyle economy for decades to come.

Copyright © 2025 Panorama Properties S.L. – Special thanks to Alfonso Muñoz, Carolina Alaniz, Cheryl Gatward and Alex Clover for their assistance and tireless efforts in putting this report together.

Sources

- European Best Destinations, 2024.

- European Best Destinations, 2022.

- Michelin Guide.

- Excmo Ayuntamiento de Marbella: “The Marbella census maintains its sustained growth of recent years and will reach 166,999 inhabitants by the end of 2024”, January 7, 2025.

- Excmo Ayuntamiento de Marbella: “Demografía y Socioeconomía”.

- Sur in English: “Costa del Sol leads European market for luxury residences managed by big-name hotel chains”, August 25, 2025.

- Panorama Properties: “The Four Seasons Resort Marbella”, August 12, 2025.

- Idealista: “Branded residences, the new real estate trend in Spain”, September 17, 2024.

- Idealista: “Versace enters Marbella’s luxury real estate market with 2,000m2 villas”, September 23, 2024.

- El Confidencial: “Marriott swaps Marbella’s future W for a super-luxury St. Regis or Ritz-Carlton”, November 25, 2024.

- El Economista: “El mapa de las 10 calles más caras para comprar vivienda en España”, August 21, 2025.

- INE Instituto Nacional de Estadística: “Estadística de Movimientos Turísticos en Fronteras”, February 3, 2025.

- Hosteltur: “España se encamina a lograr 100 millones de turistas extranjeros en 2025”, June 10, 2025.

- Excmo Ayuntamiento de Marbella: “Marbella closed 2024 with record tourism figures and achieved the highest occupancy and best hotel profitability in its history.” February 2, 2025.

- SUR: “Domestic tourism down 34%, but hotel profitability in Marbella remains stable.” August 5, 2025.

- SUR: “Marbella registra en agosto nuevos máximos históricos en rentabilidad hotelera”, September 28, 2025.

- Marbella24horas.es: “Marbella recuperó turistas hoteleros en julio gracias a los extranjeros.” August 23, 2025.

- The Epoch Times: “Never-Ending Summer is Changing Mediterranean Holidays”, August 15, 2025.

- Excmo Ayuntamiento de Marbella: “La alcaldesa afirma que “la sostenibilidad transversal ha sido clave para consolidar a Marbella como referente de calidad y excelencia”, April 23, 2025.

- Aena: “Destinos del Aeropuerto de Málaga-Costa del Sol”.

- SUR: “El aeropuerto de Málaga alcanza un récord de hasta 60 vuelos privados al día en verano”, September 11, 2025.

- EuroWeekly News: “Malaga airport first to offer drone taxis”, May 27, 2025.

- Letter of Introduction to The Marbella Property Magazine vol. 15. August 15, 2024.

- Ministerio de Transportes y Movilidad Sostenible (formerly Fomento): Transacciones inmobiliarias (compraventa).

- Ministerio de Transportes y Movilidad Sostenible (formerly Fomento): Transacciones inmobiliarias (compraventa).

- Idealista: “Marbella housing prices already exceed 5,200 euros/m2 in July”, August 29, 2025.

- Ministerio de Transportes y Movilidad Sostenible (formerly Fomento): Transacciones inmobiliarias (compraventa).

- Ministerio de Transportes y Movilidad Sostenible (formerly Fomento): Transacciones inmobiliarias (compraventa).

- Portal Estadístico del Notariado

- Idealista: “Evolution of housing prices for sale in Marbella”

- La Opinión de Málaga: “El sector de la construcción en Málaga requerirá de 40.000 trabajadores en cinco años”, August 1, 2025.

- Knight Frank: “The Wealth Report”, 2025.

- Knight Frank: “The Wealth Report”, 2025.

- Knight Frank: “The Wealth Report” 2024.

- Estadística Registral Inmobiliaria, 2024.

- Idealista: “Evolution of rental housing prices in Marbella”, August 2025.

- El País: “Málaga anuncia una moratoria de tres años para nuevas viviendas turísticas”, August 13, 2025.

- Cadena SER: “Málaga, la provincia con más viviendas turísticas en el registro único, con casi tantas como toda Cataluña”, August 3, 2025.

- LPA: “How 2025 Legislative Changes Are Reshaping Tourist Rentals and Property Values in Marbella”.

- Condé Nast Traveler: “What to Know About Spain’s Golden Visa Before It Ends in April,” Condé Nast Traveler, January 23, 2025.

- Marbella24horas.es: “El documento final del PGOM de Marbella sale adelante con PP y Vox”, June 27, 2025.

- Málaga Hoy: “Marbella aprobará el PGOM en junio de manera definitiva”, May 28, 2025.

- SUR: “Marbella supera por primera vez las 83.000 afiliaciones a la Seguridad Social en un mes de junio”, July 16, 2025.

- Latinpress.es: “Marbella supera por primera vez las 83.000 afiliaciones a la Seguridad Social en un mes de junio”, May 24, 2025.

- El Español: “Marbella planea eliminar su mayor punto negro de tráfico con un tercer carril en la A-7 entre Puerto Banús y San Pedro.”

- SUR: “Comienzan los trabajos del estudio de viabilidad para el tren litoral entre Nerja y Algeciras.” June 11, 2025.

- SUR in English: “Expansion process under way for close-to-capacity Málaga Airport to handle 36 million passengers a year.” July 30, 2025.

- SUR in English: “Head of Junta opens upgraded Marbella desalination plant and demands more commitment from central government.” July 9, 2025.

- SUR in English: “Costa del Sol desalination plant starts testing phase”, February 21, 2025.

- Europapress: “El Ayuntamiento de Marbella aprueba sus cuentas de 2025 con 405.259.949 euros de gastos consolidados”, December 23, 2024.

- Sur in English: “Marbella sees 290-million-euro investment in new and refurbished hotels”, February 24, 2025.

Know more about Panorama

Marbella’s leading real estate agency since 1970

Marbella’s longest established real estate agency. We are a company run by a family celebrating its fourth generation of real estate professionals.

Our philosophy is simple: to give our clients the highest level of professional service of any real estate agency anywhere.

Popular Property Searches, Marbella and the Costa del Sol

View Panorama's extensive portfolio of luxury properties for sale in Marbella and surrounding areas

Main locations of Panorama's properties for sale